USDIQD Stock Sentiment: What Experts & Data Say [2024 Guide]

Are you trying to navigate the turbulent waters of the Forex market, specifically concerning the Iraqi Dinar against the US Dollar (USDIQD)? Understanding market sentiment is paramount to making informed investment decisions, but sometimes, the data seems elusive, shrouded in ambiguity.

Many investors and traders grapple with the challenge of gauging the prevailing sentiment surrounding currency pairs like USDIQD. This is crucial because sentiment, reflecting the overall mood and expectations of market participants, can significantly influence price movements, often independently of fundamental economic factors. Analyzing market sentiment involves parsing a complex interplay of news, economic indicators, technical analyses, and even social media buzz. The quest for a clear signal is often met with contradictory information and the inherent volatility of the currency market.

| Aspect | Details |

|---|---|

| Currency Pair | USDIQD (US Dollar / Iraqi Dinar) |

| Current Sentiment | Neutral (as of the latest available data) |

| Forecast (Next Month) | Iraqi Dinar (IQD) is expected to appreciate against the US Dollar (USD) by approximately 0.52%. The exchange rate is projected to increase from $0.000759 to $0.000763. |

| Data Sources | MarketWatch, financial news outlets, currency exchange platforms, stocktwits community, and various technical analysis tools. |

| Key Indicators |

|

| Risk Factors |

|

| Mitigation Strategy | Diversification of investments to reduce risk exposure. |

| Additional Resources |

|

| Reference Link | MarketWatch |

Understanding the Iraqi Dinar (IQD) and its relationship with the US Dollar (USD) requires careful consideration of various factors. The forecasted increase of 0.52% in the IQD to USD exchange rate over the next month, while seemingly small, can be significant for large transactions. The projected rise from $0.000759 to $0.000763 reflects an anticipated strengthening of the IQD. However, this forecast is only one piece of the puzzle.

Currently, the prevailing market sentiment toward the IQD/USD pairing is deemed neutral. This suggests a lack of strong conviction among traders and investors, potentially indicating a period of consolidation or indecision. A neutral sentiment doesn't necessarily mean inactivity; rather, it implies a balance between bullish and bearish forces, making it challenging to predict short-term price movements with certainty.

Marketwatch, a prominent source for financial news and analysis, plays a crucial role in providing information that shapes market sentiment. Its comprehensive coverage of stock markets, financial news, and business developments offers valuable insights for those tracking the IQD/USD exchange rate. Accessing stock market quotes and personal finance advice can help investors make more informed decisions.

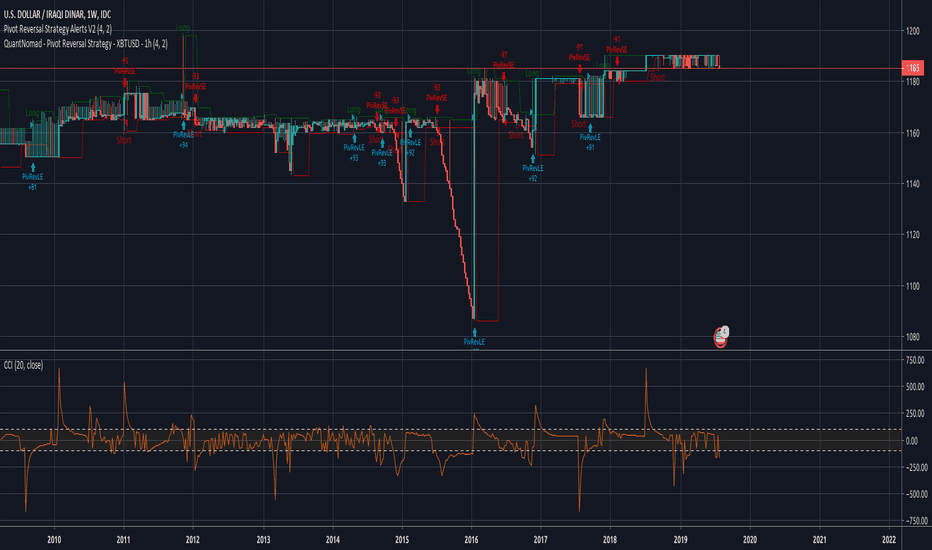

The ability to track the historical dynamics of the IQD/USD exchange rate is invaluable. Charts and tables that illustrate the changes over different timeframesa week, a month, or a yearprovide a broader perspective on trends and potential patterns. Understanding these dynamics allows investors to assess the volatility and potential risks associated with this currency pair.

- The Parisian Agency Netflixs Luxury Real Estate Reality Show

- Chlo Matt Exclusive Content Why Cant I Find It Tips

One must be aware that stock prices, and by extension, currency values, are susceptible to a multitude of influences. Economic trends, global events, and overall market sentiment can all impact the IQD/USD exchange rate, even if the underlying economies of Iraq and the United States remain stable. This susceptibility underscores the importance of staying informed and diversifying investments to mitigate risk.

A single stock, or in this case, a currency pair like IQD/USD, can experience price declines due to various factors. These can include earnings misses, negative news, or management decisions. While these factors are more directly applicable to stock valuations, analogous events can impact currency values. For example, political instability in Iraq or changes in US monetary policy could adversely affect the IQD/USD exchange rate.

Diversification remains a key strategy for mitigating risk in any investment portfolio, including those involving currency trading. By spreading investments across different asset classes and currencies, investors can reduce their exposure to the volatility of any single asset. This approach can help cushion the impact of unexpected events or adverse market conditions.

The Fear and Greed Index serves as a valuable market sentiment indicator. It aims to gauge investor sentiment by assessing the degree of fear or greed prevailing in the stock market. Ranging from 0 (extreme fear) to 100 (extreme greed), the index aggregates data from various sources, including market momentum, stock price strength, and safe-haven demand. It helps to determine whether investors are overly bullish or bearish, providing a contrarian perspective on market trends.

The Fear and Greed Index combines diverse data points to provide a comprehensive assessment of market sentiment. By considering factors such as market momentum, stock price strength, and demand for safe-haven assets, the index offers a more nuanced understanding of investor behavior than relying on a single metric. This holistic approach enhances its utility as a contrarian indicator.

As a contrarian indicator, the Fear and Greed Index can be used to identify potential buying or selling opportunities. When the index indicates extreme fear (close to 0), it may suggest that the market is oversold and poised for a rebound. Conversely, when the index indicates extreme greed (close to 100), it may signal that the market is overbought and due for a correction. However, it's important to note that the index should be used in conjunction with other forms of analysis, rather than as a standalone predictor.

To gain a comprehensive understanding of the USDIQD market, it's essential to identify and monitor relevant market signals. These signals can include changes in trading volume, price breakouts, and key technical indicators. By tracking these signals, investors can gain insights into potential shifts in market sentiment and adjust their strategies accordingly.

Access to the latest price data and stock quotes for USDIQD is critical for making informed decisions. Real-time data allows investors to track price movements and identify potential trading opportunities. Various financial websites and platforms provide this data, often accompanied by charts and technical analysis tools.

Examining historical data, charts, and relevant news is crucial for understanding the factors that have influenced the USDIQD exchange rate in the past. Historical analysis can reveal patterns and trends that may provide insights into future price movements. It can also help investors assess the long-term stability and potential risks associated with this currency pair.

The latest USD/IQD exchange rate, as of March 9, 4:48 am UTC, is a critical data point for anyone involved in currency trading or international transactions. Accessing live price information, interactive charts, historical data, and expert forecasts is essential for making timely and informed decisions. These resources are typically available on financial websites and trading platforms.

This page offers insights into user sentiment regarding the US Dollar Index (DXY), presented through charts spanning various time periods and a detailed table. Understanding the prevailing sentiment toward the US Dollar can provide valuable context for analyzing the USDIQD exchange rate, as the strength of the US Dollar often influences its value relative to other currencies.

Exploring the US Dollar Index (DXY) market and community sentiment can provide a broader perspective on the factors influencing the USDIQD exchange rate. Analyzing message volume, participation scores, and buzz levels within the Stocktwits community can offer insights into the collective mood of traders and investors, which can impact price movements.

Analyzing US Dollar USDIQD widescreen charts, along with technical indicators such as DMA, SMA, EMA, ADX, MACD, RSI, and CCI, is essential for conducting thorough technical analysis. These tools can help identify potential trends, support and resistance levels, and overbought or oversold conditions. By combining technical analysis with fundamental analysis and sentiment analysis, investors can develop more robust trading strategies.

Employing DMA, SMA, and EMA technical analysis techniques can provide insights into the underlying trends and momentum of the USDIQD exchange rate. These moving averages smooth out price data over different time periods, making it easier to identify the direction of the trend and potential support and resistance levels. Using these indicators in conjunction with other forms of analysis can enhance the accuracy of trading decisions.

ADX, MACD, RSI, and CCI are additional technical indicators that can provide valuable insights into the USDIQD exchange rate. ADX measures the strength of a trend, while MACD indicates the relationship between two moving averages. RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions, and CCI identifies cyclical turns in the market. Combining these indicators can provide a more comprehensive view of market dynamics.

Article Recommendations

- Easy Raspberry Pi Remote Ssh Access A Stepbystep Guide

- Sava Schultzs Shocking Betrayal Onlyfans Leaks More

:max_bytes(150000):strip_icc()/dotdash_Final_Market_Sentiment_Nov_2020-01-0b3907c75fdd4e9e9d05c82851465244.jpg)

Detail Author:

- Name : Jaclyn Hamill

- Username : lucienne37

- Email : powlowski.allison@lehner.com

- Birthdate : 1988-08-16

- Address : 5253 Robel Pines Sanfordborough, KY 67170-2118

- Phone : +14457174732

- Company : Legros, Weissnat and Koepp

- Job : Human Resource Manager

- Bio : Mollitia voluptatem alias quia voluptatibus. Et aperiam eaque tempora fugiat optio est. Dolorum voluptates dolorum dicta est quibusdam illum rerum. Sit pariatur velit eos in vel.

Socials

twitter:

- url : https://twitter.com/block1977

- username : block1977

- bio : Non quo assumenda eos corporis non suscipit quisquam hic. Est ea porro et qui non quas nesciunt occaecati. Qui totam ullam voluptatem et est sint in.

- followers : 6888

- following : 996

instagram:

- url : https://instagram.com/block1978

- username : block1978

- bio : Amet perferendis eveniet quibusdam blanditiis est. Quaerat voluptatum facilis maiores eos.

- followers : 6633

- following : 559

tiktok:

- url : https://tiktok.com/@block1994

- username : block1994

- bio : Voluptatem magnam dignissimos illum necessitatibus qui cum et quisquam.

- followers : 6037

- following : 1310